During 2017, the frenzy in the investment community that arose from the accelerating valuations of anything with the phrase “crypto” in front of it harkened back to asset bubbles of the past. Countless examples were brought forward in the financial press, but no one wanted to be apprised of the risks involved. Everyone knew that asymptotic growth rates always fall as quickly as they rise, but memories were short. No one wanted to miss out, but no one considered the possibility that they might be the one left holding a bag of air.

The asset bubble did burst in early 2018. Investors are licking their collective wounds, although those lucky enough to exit at the right time are smiling broadly with a mound of cash. The experience reminded everyone that paper gains mean nothing until they are cashed out and put in a bank account. Valuations are now at saner levels, and the enthusiasm over the “crypto” space has not diminished. Aside from buying and selling on an exchange, there are investors that prefer mining operations or Initial Coin Offerings (ICOs), the newest way to raise investment seed capital on the street, but very risky.

Both vehicles offer an avenue to participate in the crypto-wave, so to speak, but each vehicle is unique, and, unfortunately, organized crime has focused on both with updated versions of tried-and-true scams. The level of fraud witnessed in this sector has drawn the ire of regulators, which have gone on record to declare each vehicle to be a “security” under the law, thereby requiring registration, regulatory compliance, and significant disclosures on the front end to protect the investing public at large. Chinese officials went so far as to deem ICOs a threat to financial stability and banned them.

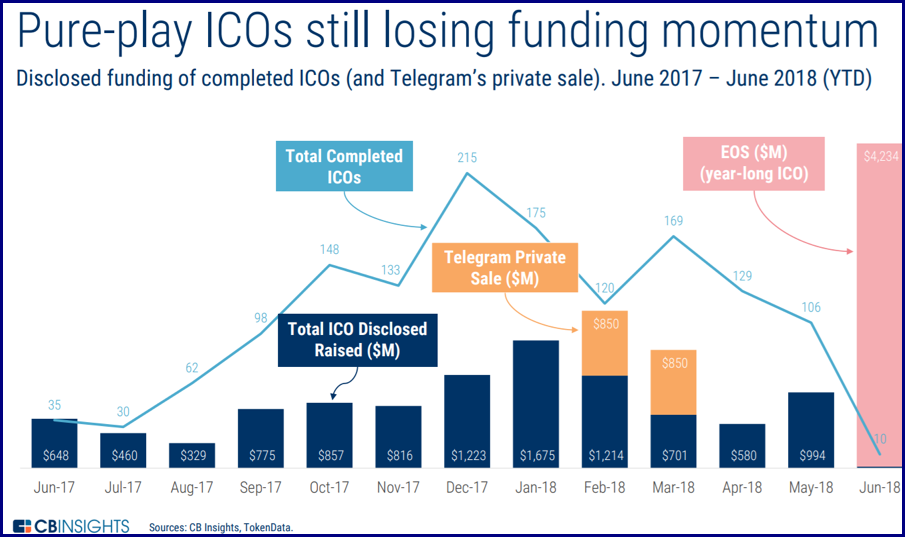

Investing in a mining operation is a standard stock transaction, generally following the path of new venture funding. With an ICO, you do not buy ownership in the entity. You buy tokens, which you hope will appreciate in value, as the firm gains traction with its product or service in the marketplace. Regulators and courts have ruled that the latter is close enough in “substance”, rather than “form”, to be considered a security. Following these rulings, the momentum for ICOs went into decline, even though nearly $6 billion was raised globally in 2017 from this funding mechanism. There may have been over 1,100 ICOs through 2017, but a majority of the capital is concentrated in ten ventures.

How are fraudsters attacking this space? It has become common to hear of a new scam in this space on a monthly or even a weekly basis. The form of attack can take on any one of the following six categories:

In most instances, the crooks in charge know when to exit stage left, leaving a financial mess behind and investors screaming for their money. Sadly, capital recovery is nearly out of the question in most cases. If you wish to invest in this space, do serious due diligence and heed the words of this insider: “With over a thousand existing offerings and more to come, it is highly unlikely that many of these experimental projects will succeed. Fraud is also a given, but this craze is very reminiscent of the Internet some years back, when investors threw money at anything that involved the world wide web. Far too many entities are scrambling for far too few opportunities. Many will fail. Many investors will lose their entire investment.”