Volatility is back in the cryptocurrency world! In the matter of a single day, the market capitalization for all crypto offerings fell some $30 billion in value, thereby creating a wave of anxiety across the virtual coinage world. The last few months had been uneventful, especially while stocks and bonds were taking it on the chin in October. Cryptocurrencies, however, tend to fluctuate wildly when there is any kind of news in the press, but this time, analysts were scratching their heads in wonderment, searching for clues to explain the causes for the widespread carnage.

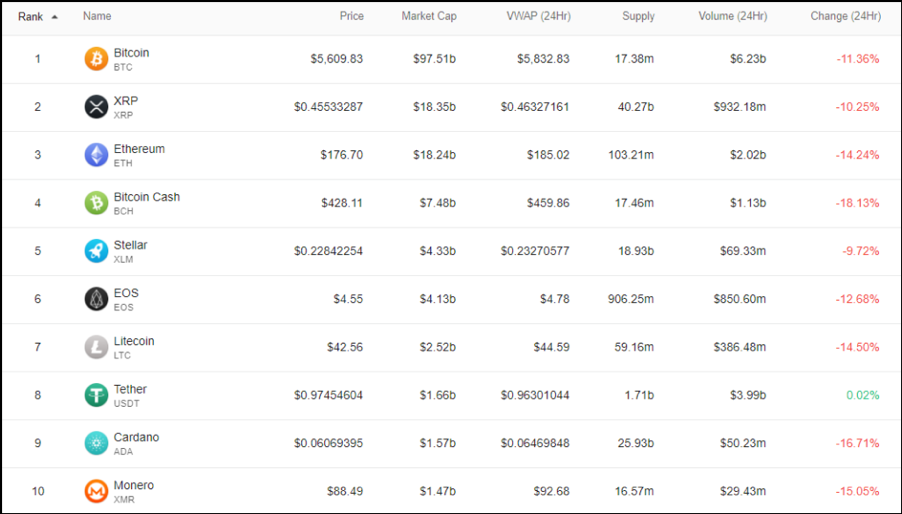

Bitcoin did fare better than most of its rivals. Ripple, Ethereum, and Bitcoin Cash were pounded, as well, but lesser known coins and ICOs were bashed even more. The chart below provides details for the “Top Ten” programs, before BTC hit $5,542:

Bitcoin valuations had been range bound for several months, bouncing around the mid $6,500 level. Trading volumes were down, in line with the low volatility experienced during the summer months. A few industry analysts had noted earlier that the technicals were signaling weakness, a nice way of saying that it might be time to test the $6,000 boundary line for support. Technicals, however, rarely drive market action. Fundamental news stories carry much more weight in this world.

When the test did materialize, it quickly penetrated $6,000 and headed further south, finally rebounding off of $5,500, a price point that Bitcoin had not seen since October of 2017. Ripple was only moderately better, as were a few other name brands, but at the end of the day, a $30 billion slide in market cap translated to an overall market decline of roughly 14.2%, a bitter pill to swallow by any means.

As for reasons of a fundamental nature, believe it or not, many equity holders in October shifted to Bitcoin during the massive capital flight to safe havens from that sector. When November began, the world on the Street was that equities would rebound and squeeze a bit more value out before cresting at a new equilibrium. Hedge fund managers and investors suddenly flipped direction, including, it seems, a portion of the crowd that had sought safety in Bitcoins. Investors giveth one day, only to taketh back the next.

A more likely reason, however, has to do with Bitcoin Cash. A “Hard Fork” is scheduled for the 15th of November. A hard fork, or sometimes hardfork, as it relates to blockchain technology, is defined as “a radical change to the protocol that makes previously invalid blocks/transactions valid (or vice-versa). This requires all nodes or users to upgrade to the latest version of the protocol software. Put differently, a hard fork is a permanent divergence from the previous version of the blockchain, and nodes running previous versions will no longer be accepted by the newest version. This essentially creates a fork in the blockchain: one path follows the new, upgraded blockchain, and the other path continues along the old path”

Bitcoin Cash was actually spun off from Bitcoin via a contested hard fork. The industry has endured these splits before, but where there is doubt, fear, and uncertainty, investors tend to hide, i.e., close their positions and run for cover until the storm has passed. When the selling starts, risk-wary investors join in to follow the herd, while attentive traders jump onboard the trend and ride it out for all that it is worth.

Analysts are still looking for more reasons, and one may be what transpired at the 33rd Asean summit in Singapore. International Monetary Fund chief Christine Lagarde began speaking about cryptocurrencies to the fintech conference in a way that sounded like a new plan of attack by the regulatory community. She spoke in favor of digital currencies, as if supporting the innovative desires of financial technology professionals, but then she added a twist – central banks should create cryptocurrencies of their own making, in order to “bring about financial inclusivity, better security and consumer protection, as well as allay privacy concerns. And of course, we expect it to be cheap and safe, protected against criminals and prying eyes. Identities would not be disclosed to third parties or governments unless required by law.”

Regulators have always wanted to have the power to raise the veil of anonymity in the crypto world, always fearing the worst from organized crime, money laundering, and the funding of terrorist organizations. It appears that there might be one more test on the horizon, if the IMF has any influence on the matter. Cryptocurrencies have survived other bumps in the road, and there is no reason to feel otherwise this time around.