If I have to make a choice, should I invest in Bitcoin or Ethereum? As traders, we are always confronted with a single question — where is the best opportunity to take a position at the moment at hand? In other trading arenas, we can use our technical tools to guide our decision-making process, but in the crypto world, there is so much price volatility that traditional technical tools do not provide the “edge” that we would normally rely upon before we entered the market. There is, however, another gambit that we can try – how do various coins correlate to one another, and do these relationships yield any valuable insights worthy of our consideration?

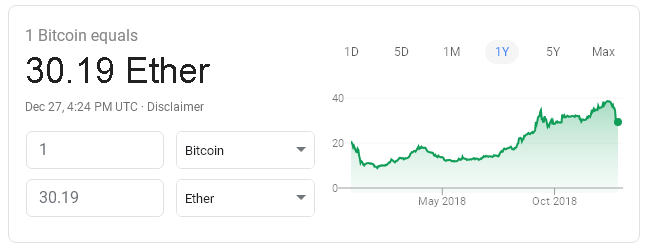

In the precious metals sector, “Gold bugs” are forever checking the ratio between Gold and its sister metal, Silver, to see if there are any indications that the market is due to favor one item over the other. Cryptocurrencies may be in their infancy, but traders and analysts have eagerly applied old maxims to this territory in hopes of discovering a tip that others may have missed. Ratio charts between BTC and ETH are readily available for differing time periods. For now, let’s begin with a yearly version:

It appears that for the greater part of 2018, except for the beginning and the recent few weeks, the market has favored Bitcoin over Ethereum. The ratio peaked at “38” in mid-December, causing analysts to scratch their respective heads in unison – what could be happening to cause such a reversal, and was it a trend that could be an opportunity worthy of pursuing?

Before reviewing the activity over December, let’s try to understand why the gradual improvement over the year favored BTC over ETH. Both coins can be used to purchase items or be purchased as an investment. Ethereum, however, has an additional trait. It is the development platform of choice for blockchain programmers desiring to create the next great blockchain application. The majority of Initial Coin Offerings (ICOs) begin with the Ethereum platform, before the first line of code is ever written.

What does BTC have that ETH does not? As the market leader with roughly 53% of the market capitalization of the entire crypto world, Bitcoin has earned a reputation as the best “store of value” for any of the tokens in existence. The gradual rise could be attributed to investors choosing Bitcoin for the long haul and for whenever there is a bump in the blockchain development arena. The fact that a preponderance of ICO failures has dominated headlines over 2018 could lead one to think that BTC would be considered a “safer haven” rather than ETH, if a choice had to be made.

Structural nuances can also cause investors to act differently. Hsaka, a cryptocurrency trader and technical analyst, has offered up these words of explanation: “Quite a substantial difference between the ETH and BTC structure. If you were betting on correlation remaining the same, and both reverting to structural equilibrium, $ETH seems to be the better play for shorts, and BTC for longs.”

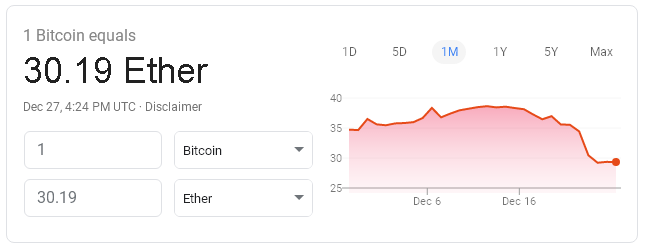

Now, let’s take a look at a shorter timeframe chart, a one-month version:

In one week the “BTC/ETH” ratio plummeted from 38 down to 30. What could cause such a quick reversal? Whatever the case, Ether would have had to appreciate more quickly or depreciate less quickly than Bitcoin for such a change to manifest itself. In actual fact, the former was true. Ether had a very successful week, posting a 66% gain, before pulling back a bit. As for Bitcoin, a meagre 25% recovery was booked with a similar pullback, as well.

If Hsaka is correct, then we might have witnessed a strong short squeeze taking place on behalf of Ethereum. It may just be that professionals that short for a living got overconfident in their short ETH oppositions, got a bit greedy, and then ran for the exits when it was too late. Short squeezes are common in the equity world, and it now appears that the same may be true for Cryptos, at least for Ethereum, that is. You might want to remember this fact the next time Ethereum hits a protracted slump. At some point, the race will be on when another squeeze occurs. To be forewarned is to be forearmed!

As for the crypto sector in general, has a bottom been reached and will it hold? When speculators drive the trading action, it is difficult to call a bottom, but, for those that follow volume statistics, they seem to be optimistic: “Major crypto assets have been demonstrating strong daily volumes, with the daily volume of the crypto market surpassing $20 billion. As long as Bitcoin and Ethereum can sustain their volumes, small market cap cryptocurrencies are likely to follow the price trend of the two digital assets.”