As you make a move from trading stocks to CFD trading and then to Forex trading, you will notice the importance of building new Forex trading strategies..

Currency trading, foreign exchange trading or just FX trading is an entirely different beast compared to other asset classes.

You will experience an entirely different set of highs and lows and considerably less sleep too. But that is why so many people start trading Forex.

We’ve put this in depth post together for those who want to learn Forex, learn several trading strategies and maybe even consider the idea of trading Forex signals. More on this later.

At the end of the day, as a Forex trader, your number one goal is to generate pips, which means profits.

We’ll look at some different Forex trading strategies you can consider, test, and look to apply within your overall trading strategies.

Now, the first part of your Forex trading strategy will be your trading plan.

Your trading plan will be the cornerstone of any success or lack of achievement you will have in the currency market.

A Forex trading strategy is important because it helps you build your confidence. You can also start to apply those strategies showing signs of promise. Next, you need to maximise your winning trades.

Your Forex trading strategy must give you a clear set of rules you can follow.

Thousands of traders start off in an ad-hoc manner. They chop and change their strategy and never settle on any one forex strategy for any length of time.

Instead, you want to build a sensible Forex strategy, enabling you to scale up your position sizing (eventually).

Your rock solid Forex trading strategy will combine:

With those key components in place, you stand a much greater chance of success.

You have heard the saying, “People don’t plan to fail, they just fail to plan.”

What you need to do is make sure you’ve got a sensible, rock solid Forex trading strategy and build that into your trading plan.

Without this framework, you will not be able to be a full-time Forex trader.

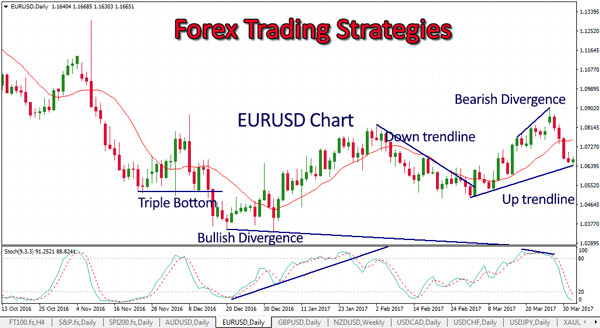

One of the most traditional methods of trading the Forex markets is using technical analysis.

Technical analysis is an extremely popular Forex day trading strategy because it is easy to learn.

Many people think technical analysis is some form of trading witchcraft. But the reality is, technical analysis is using mathematical formulas, called indicators, which you apply over your charts.

Now, these indicators give you an idea of what has happened based on historical information.

Indicators are mathematical formulas that look at the price and volume action to give you an idea of what has occurred in the past.

Unfortunately, they are not forward looking, and they cannot give you a crystal ball at what the future might hold.

What you need to do is learn to use the Forex indicators and technical analysis in a way that provides you with a trading edge.

Successful forex traders are looking to put the odds in their favour.

Forex traders win around 40-60% of the time, depending on their trading strategy.

Your goal isn’t to win 100% of all your trades. Instead, your goal is to create an edge that enables you to extract profits on a consistent basis.

Now, the most common way to use technical analysis when trading Forex is to apply a couple of indicators.

Each indicator looks at historical information in a specific manner.

Indicators will help you identify:

The good news is there are hundreds of excellent technical analysis books to learn from.

Now, the other part of technical analysis, which a lot of people don’t discuss, is the fact that so many people use it.

Even if you trade using fundamental analysis, it is essential to learn the key technical analysis (TA) indicators.

By understanding TA, you can understand where and why the majority of the market is sitting at certain prices. As we’ll discuss further down, once those key technical levels are broken, a fast run is inevitable.

You must learn technical analysis to help you:

Once you know this, you can combine it with your fundamental analysis to create a robust and rock solid Forex strategy.

Over the last decade, Forex signals have become more and more popular. The reason for this is trading Forex challenging.

Profitable forex trading takes a lot of time, effort, patience and discipline.

The big challenge with Forex signals is the fact there are thousands to choose from.

Here is a unique idea.

Instead of trying to find the best Forex signals for untold wealth and riches, use them for new trading ideas.

If you are new to trading, Forex signals could be perfect.

Let me paint a picture of how this might work.

Firstly, find a Forex signal service which has a demonstrated historical track record of success.

Then, if all looks ok, start trading it with no leverage and with very small position sizing.

The reason why this is ideal for new traders is because:

Even if the Forex trading signal ends up losing pips and makes a loss, you will learn a lot of lessons from it.

Your number one goal is to get some ideas on what it takes to trade the Forex markets.

If you’re new to trading, applying a Forex trading strategy or signal service from someone with a demonstrated track record will give you lots of trading ideas.

Potentially, this will fast track your trading education around the Forex markets.

What you want to do is understand their entry strategies.

What makes them enter each FX trade?

You will not get the exact signals they use. It’ll be what they call a ‘black box trading setup.’

You won’t know exactly how they generate those signals. But once you’ve traded every forex signal for a full month, you’ll get a perfect feel for their trading strategy.

Your key goal here is to get ideas around entries and to get ideas around exit strategies.

You will also have a foundation of money management. If they are any good, they will tell you the type of money management you should be applying to your account.

If not, send the support team an email and ask them, “What sort of money management and risk management strategies do you suggest to trade your Forex signals with?”

Even when you are building your trading strategies, you may like to subscribe to different Forex signals throughout the year.

If you do subscribe to signals, test them at the lowest Forex leverage and safest risk management strategies. This is a testing and ideas phase.

You cannot predict what’s going to happen in the future. So your best bet is to look at their past results to see if it fits in with what you’re trying to do.

Have you noticed how the life of a Forex trader seems so exciting?

When you have a look online, there are so many pictures of yachts and fast cars, fancy holidays, and trading from the beach.

Now I’m pretty sure there aren’t any Forex traders who are trading from the beach using a laptop.

For one, the sand will get everywhere. It’ll be so frustrating in the sun. You can’t turn the resolution on your screen up enough to see the charts.

You need to be able to react fast with Forex trading. Trading on the beach is a no-go.

The best trading times for Forex traders are the European Open. This is also called the London Fix.

Active Forex traders will trade the London open through to the US session open and beyond.

Knowing the key trading times is important so you can find the most volatility.

A Forex trader is not too concerned about the open of the New Zealand market. Even though it is the close of the US market, it is still relatively quiet.

Even the Australian session is met with very little volatility. If you’re based in Sydney, the active time for you could start as early as 2 PM, but normally closer to 5-6pm.

Of course, if you’re trading the Australian dollar and the RBA interest rate decision is pending, then, of course, there will be volatility. You will see some moves of 50-100 pips on the Aussie dollar at this time.

A lot of people ask, “Well, how do you become a Forex trader?”

Now it does sound like a fascinating life, but do understand that you need to be quite analytical.

You need to be willing to test a lot of trading strategies.

You must understand your risk and money management.

Your most important aspect as a Forex trader is to preserve your capital.

You need to be very mindful of your edge in the markets.

Becoming a full-time Forex trader is no walk in the park. Many of the most successful Forex traders will tell you it is a seven to ten-year apprenticeship.

Keep that in mind when you’re looking to become a Forex trader.

Do you love using indicators on your charts?

All the best Forex trading platforms, such as MetaTrader 4 (MT4) or C-Trader, come prebuilt with hundreds of indicators. The list of MT4 Shortcuts is impressive too.

You have every single indicator you could imagine.

The best Forex indicators are the ones that help you shortlist the opportunities across your preferred time frame and trading style.

For example, if you’re a trend follower capturing trends in the market, then the best Forex indicators are moving averages.

Moving averages are excellent at keeping you in trending markets.

Click play on the video below, which highlights 6 excellent Forex moving average trading strategies to consider.

However, markets don’t trend all the time. So when the markets aren’t trending, moving averages will get you chopped in and out of the market. During a choppy phase of the market, you will suffer lots of small losses.

Trading trend following indicators on the Forex markets during a choppy market is very, very frustrating.

You need to consider the type of market you’re trading and how each indicator works for that market type.

If you’re a reversal trader, then the best indicators to use on your Forex charts are oscillators. Oscillators are perfect for range trading.

Oscillators are indicators such as Stochastics, RSI, and Bollinger bands. These indicators look for over bought and oversold levels in the market. Some consider using oscillators as advanced Forex trading, but they are quite simple.

If the market is range bound and it’s heading down towards support, then the Stochastics or the RSI will indicate the market is currently oversold and looking for a bounce.

Now, remember all of these are just mathematical formulas applied to price and volume. They are not predictive of what is going to happen in the future.

But what you can do is use Forex indicators with a confirmation in price direction. So the stochastics shows oversold, and you put a stop-to-enter above the current price. This means you will only get set when the price moves in your direction.

Once set, you can trade it up to resistance. You may even like to place a profit taking limit order at resistance. If the price hits your expected level, you will close the trade.

The third style of trading the Forex market is breakout trading.

Here you are looking for forex indicators to highlight a price and volume breakout.

It’s not quite so much a Forex indicator as it is price and volume breakout levels. Keep in mind, not many Forex brokers or Forex platforms have volume plotted as you see with equities.

The best indicator here is a straight forward breach of a key support or resistance level. A simple Forex strategy.

Just to sum up the best Forex indicators, you want to identify what the style of trading you’re looking to achieve, whether it’s trend trading, range bound reversal trading or breakout trading.

Once you’ve identified your trading style, you can look to create a series of Forex indicators, which will help you identify opportunities around those trading methods.

Now, a question we often get asked is, “Can you learn Forex strategies from Forex videos and trading videos?”

Yes, you can.

There are some brilliant Forex trading videos across many YouTube channels. In Australia, there are some analysts who do daily market commentary videos. These provide an excellent overview of what is happening in the current market.

The best types of Forex trading videos you can watch and view are those that give you an idea of someone’s actual live trading strategies. You want to see their entry and exit levels.

You’ll be able to see the highs and lows they go through with their trading strategies, but more importantly, you’ll get ideas about their entry techniques.

What are they using to identify opportunities in the market?

You can then leverage those ideas and apply or alter your trading strategy based on what you notice they are doing well.

Watch the trading videos giving ideas around entry and exits and trade management.

A lot of success in trading comes down to the successful management of your open positions.

Find the channels of those who run through their Forex trade management. Learn everything you can in this area.

Your goal is to watch lots of short-term trading videos for strategies you can also apply to the medium and long-term.

Let’s say, for example; you’re a medium and longer-term Forex trader. What you might want to do is have a look for people who are trading strategies on a one or five-minute chart. That way you get to see lots of completed trades.

Once you’ve seen the type of trading they are doing, you can see if that matches with your idea around the markets of identifying trades in your time frame.

You will get plenty of medium and long-term ideas by watching completed trades on the short term.

Some of the best Forex trading strategies, and especially those that apply price action trading, are looking for the major support and resistance levels.

Support and resistance can be found at tops and bottoms, but we also look to apply support and resistance on trend lines.

You can have a look at an upward sloping trend that is finding the support levels as the market is trending higher.

In the rawest form, support and resistance trading is trying to find those levels of overbought and oversold where the market’s sentiment is suggesting this is great value down at this level. Or, this is overbought and too expensive at this high a level. That’s the basis of support and resistance trading.

One of the most effective trading strategies people apply is trading breakouts of support and resistance levels.

For example, let’s say a market has hit a certain support level three, four, or five times. The more times the market hits a particular support level, the more significant that level is.

Many traders using technical analysis put their stop loss just below a key support level.

If you get a break of a key support level, you often see a fast run down.

A break of support will trigger a number of stop losses, and the market will take a run to the downside.

A lot of institutional traders look for the key support levels in the market and push the market below.

They can afford to run a market with a significant position and take out a lot of stop losses.

The market will fall rapidly past the critical support level. At the same time, they are sitting with limits to buy, soaking it up as the nervous FX traders hit their stop loss triggers.

It pays to monitor these levels and build a price action trading strategy around them.

Forex fundamental analysis is an important part of analysing the FX majors (think EURUSD, GBPUSD, USDJPY, AUDUSD and USDCHF).

The fundamental analysis covers the key economic indicators that are essential to the market you’re trading.

The fundamental analysis you need to keep an eye on are:

Every single one of those economic reports will have an impact on the currency you are trading.

As a Forex trader, you must review the economic calendar daily.

If you have any open positions, you want to have the Forex economic calendar open at all times. You need to know on Sunday, in preparation for the week ahead, what the high impact events are within the Forex markets.

There is nothing worse as a Forex trader than being caught on the wrong side of the position once an announcement comes out.

If you’re based in Australia, a lot of those decisions happen when you’re asleep.

You will get a rude shock if you missed a major economic announcement and it’s moved against you, and now you’re nursing a significant loss.

Always keep an eye on the fundamental analysis for the Forex markets and keep a close eye on the economic calendar and the central bank websites.

Are you ready to get started?

Why not start a demo account, learn to buy or sell across the FX markets and apply some simple Forex trading strategies.

If you are still not sure, you can always enrol in a Forex trading course and learn off the best Forex educators. Forex courses which are well priced are an excellent way to fast track your Forex trading career.