As cryptocurrencies proliferated the planet, the need for reliable exchanges to match demand from buyers and sellers grew in lockstep. According to Coinmarketcap.com, there are over 2,000 coin systems in existence today, all wishing to be traded on an exchange. To meet this market demand, independent exchanges sprouted up across the globe, such that there is now an exchange in every major trading arena. There are varieties of exchanges and just as many or more crypto-pairs supported. Most will take fiat currency for Bitcoin, Ether, or Litecoin, but all other coins may require the purchasing currency to be in one of these three coinages. Not all coins are traded. For an exchange to be a market maker for a token, there are always revenue/cost considerations.

There are hundreds of these entities, each independently owned, and, for the most part, un- or under-regulated. In many cases, domestic laws require registration as a “money transfer agent”, such that there may be a few compliance rules to adhere to, but as far as common operating standards, security protocols, and customer service quality guidelines, it is an “anything goes” environment. Regulators do push Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) rules at a minimum. Some countries require that you have a domestic bank account to invest and trade, which can be an impediment, if you wish to uses an exchange outside your domestic jurisdiction.

Crypto exchanges are also, by and large, undercapitalized, and, for the most part, they operate on very thin margins. Weak security measures are a consequence, and for this reason, many exchanges have been easy prey for professional hacking gangs. There, unfortunately, is a long list of exchange compromises, where millions in customer deposits have disappeared without a trace. The largest heist occurred in 2013 when Mt. Gox, the largest exchange operating out of Tokyo at the time, was hacked to the tune of $473 million worth of Bitcoins. Bankruptcy soon followed, and the liquidation agent is still working out final settlement distributions for its customer base.

Regulators are not too keen about the obvious shortcomings of these exchanges, one reason why 88% of exchanges in a recent survey would welcome regulatory compliance and the credibility to the industry that would be forthcoming. Standards will take time and will typically evolve on a country-by-country basis. In the United States, Coinbase is recognized as having the “blue-chip among crypto platforms,” but the SEC is still not comfortable with the current status of exchange development. Jay Clayton, the Chairman of the SEC, recently expressed his concerns — primarily fraud, price manipulation, and the lack of adequate custodianship for investor deposits. Regulated exchanges have basic monitoring software regimes and custodial services, as a rule.

Although exchanges are relatively young entities, many have evolved to be large and successful in what they do for their customers. Coinbase, one of the leaders of the global group, recently raised $300 million from private investors, thereby giving it a post-funding valuation of $8 billion. Aside from making one of its owner/founders an instant billionaire, the transaction is one more indication that the cryptocurrency revolution definitely has legs and is here to stay.

Exchanges primarily service retail investors and traders. Large institutional firms, the ones that manage portfolios in excess of $200 million and deal in $100,000–plus sized transactions, are said to be the future, but liquidity issues currently stand in the way. What are institutional buyers doing today? Most hedge funds go through the backdoor by using Over-the-Counter methods to handle transactions, choosing to use a traditional broker to handle their individual trades. Price volatility is a major issue with large-valued transactions, a problem that exchanges cannot adequately address today.

For the very reason noted above, brokerage firms have been adding crypto divisions to their existing framework in order to serve the needs of their large institutional clients. There is now room for convenience-oriented brokers to thrive, as well, on a domestic level, where the need is cost-justified. As with exchanges, the brokers can act as a market maker, where they earn revenue from the Bid/Ask spread or simply charge a direct fee for using their platform, when it matches up buyers with sellers.

There are a variety of issues to consider when choosing your exchange, unless you prefer and are able to go through your local broker. Platform ease-of-use, fees and charges, transaction pairings offered, price stability, speed of closure, security protocols and history of compromises, customer service, management team experience, and financial adequacy and capitalization are but a few considerations. Each exchange has evolved on its own, in the absence of common standards, the reason for the great diversity within the group. Take your time with your due diligence phase before finalizing your choice of gateway agent.

Here is one of many online crypto exchange definitions: “An exchange is nothing more than a platform where buyers and sellers meet to conduct trades under a fixed set of rules enforced by a trusted third party – the exchange operator. By having intermediary mediate exchanges, parties are able to trade even while not knowing or trusting each other, so long as they trust the middleman. The exchange operator usually enforces rules algorithmically, while also arbitrating any conflicts that may arise.”

These exchanges are not interconnected. There is no central trading floor. In other words, each exchange determines its own set of Bid/Ask price quotes, based on the dynamics of its individual buyers and sellers. In the early days, there was an opportunity to arbitrage price differences between exchanges, but price spreads have tightened over time. There are other difficulties like having to have a bank account in the country where the exchange takes place, a rule adopted this year in South Korea. Transferring trades in order to arbitrage would then be blocked by local restrictions.

The diversity of exchanges creates competition and flexible options. Many traders may have several exchange accounts to facilitate dealing with a varied portfolio of offerings. During your selection process, heed this advice: “There is a dizzying array of offerings and options at exchanges. Some exchanges are better suited to less experienced traders and retail investors, while some are geared towards institutions or full-time traders. Though the space is hyper-competitive, each has a different fee structure, trading features, coins on offer, and security and insurance measures in place.”

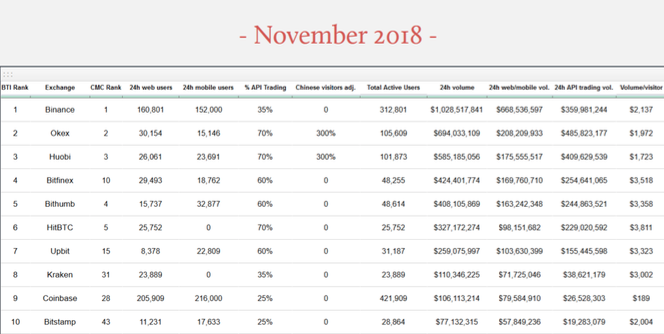

Exchanges do share data with various aggregators that report back all manner of statistics. Two well-known aggregators are Coindesk and Coinmarketcap.com. A summary of the “Top Ten” for November of 2018 is presented below:

Binance, the leading exchange by volume, actually left China when government restrictions became harsh. They currently operate out of Singapore, with multiple offices in Asia, and average over $1 billion in trading volume per day. They offer over 130 tradable coin pairs, and features are available for all experience levels of traders. They are basically unregulated, and you cannot short trade pairs or buy in fiat currency. Binance is a crypto-only exchange. There have been several issues with exchanges deliberately over reporting volume data, but, hopefully, most of these issues have been addressed before these November figures were aggregated.

Each exchange has its own platform and order types, which are similar to what you may have encountered with your forex broker. These orders are automated sets of instructions that will execute a trade in the market based on specific events, in accordance with parameters specified at the outset within the order type. Sound familiar? Yes, you will have Market Orders and Limit Orders, along with a set of more complicated order types that give you more flexibility in achieving what you want with your trades. Each exchange is different, but you will want to understand the details of how each order works.

A predominant number of exchanges follow a standard centralized model: “Similar to a traditional stock exchange, a centralized cryptocurrency exchange, or CEX, operates as the middle-man as between two parties. A “centralized” system means that one party is trusting another with some type of information, in this case, handling their money”. There have been attempts at decentralized versions and hybrids that permit settlement under different conditions, but take up has been slow. Low take up translates to low volume, low liquidity, and larger price spreads, but the one savings grace is that there is a lower probability of your account tokens disappearing, a major plus.

The fraud issue with exchanges actually spawned a separate industry – crypto wallets. Nearly a dozen firms not compete for market share of $95 million in annual revenues. These hardware devices and their software can encrypt your private keys, keep your account offline, outside of an exchange and potential hackers, and allow you to send coins directly to others in the blockchain. At some exchanges, like Coinbase, your funds are held in what is called a “hot” wallet, because it is online and directly accessible on the Internet. “Cold storage” or “Cold” wallets are separate hardware devices that can plug into a USB port to enable trading. Wallets have become an integral part of the crypto world, each with its own features and security procedures.

Per one report: “Since 2011, there have been over 60 cyberattacks aimed at cryptocurrency exchanges and other digital currency platforms. Renowned attacks including Mt. Gox (Japan, 2014), Bitfinex (Hong Kong, 2016), Coincheck (Japan, 2018), Coinrail (South Korea, 2018), and Bithumb (South Korea, 2018) continue to present a high potential for system crashes. But, what did each of these attacks have in common? The attacks were all targeted towards CEXs, attracting the attention of black hat hackers galore.” Total loss figures, when expressed in current dollars, are in the billions.

Why are exchanges so susceptible to hacking? Today’s hacking gangs are way ahead of the curve, so to speak, both in the crypto arena, as well as in most any other form of financial service. Crypto currency exchanges have drawn more than their fair share of losses primarily due to the “immaturity” of the industry. Hackers tend to break into “wallets” maintained within the exchange, an accounting vehicle that rests outside of the revered blockchain technology. If your personal credentials are hacked in the process or from your own computer, any losses are your own to absorb, unless the exchange has specific protection policies or coverage from an insurance scheme.

What needs to be done to curb this problem? Per one industry insider: “The question is: is there any limit to these hacks? After every few months, we are seeing the same pattern emerging. This is the result of loose regulatory control, and regulators must step in to protect the consumers. Anyone who wants to do anything with exchanges should be forced to adopt high-grade security and regular security upgrades.”

In 2013, there were 23 crypto exchanges in operation. Current best estimates put that figure at 200. The smart exchanges are presently speaking with regulators, seeking guidance on how to clean up the industry. The problem, however, is widespread. Per one insider: “Billions of dollars are traded daily, yet many exchanges have no security procedures in place. There are increasing numbers of irregularities reports, and on top of that both clients and exchanges are at risk of being hacked.”

Back in February of 2018, U.S. Commodity Futures Trading Commission (CFTC) Commissioner, Brian Quintenz, encouraged operators to adopt self-regulatory standards in an attempt to police the space: “I think a self-regulatory organization, or SRO, for cryptocurrency exchanges could spur the development of standards around cybersecurity policies, data retention, protection of customer accounts, trading practices and other issues.”

The issue, however, is global. Regulatory oversight is needed and welcomed in most quarters, but major enhancements are necessary for software routines, monitoring programs, and custodial care for client deposits. All will require money and expertise, but if the industry is ever to come of age and attract institutional clients, the wave that will produce prosperity industry wide, then the money must be found. The potential for price manipulation or fraud must be curtailed to an acceptable level, with compensation coverage for victims. At some point, these issues will suggest an industry consolidation, which will be a healthy next step to credibility and growth.